Note

If you created a personal account after February 13, 2025, your billing experience may differ from the information in this article. You can manage your plan and view billing details in the new billing platform. See Using the new billing platform.

If you're a GitHub customer in the United States, you need to ensure that your account is set up to calculate sales tax correctly. If you're exempt from sales tax, you can upload a certificate to your account. The format of the certificate you upload must be one of the following:

- JPEG (

.jpg,.jpeg) - PNG (

.png) - PDF (

.pdf)

Your account is marked as tax exempt while your certificate is reviewed. If your certificate is not approved, you will need to upload a new one.

Adding a sales tax exemption certificate to your organization account

You can upload a sales tax exemption certificate to your organization account if your account uses the GitHub Customer Agreement.

Note

This option is not available for accounts that use the GitHub Standard Terms of Service. For information about updating your organization, see Upgrading to the GitHub Customer Agreement.

-

In the upper-right corner of any page on GitHub, click your profile photo, then click Settings.

-

In the "Access" section of the sidebar, click Organizations.

-

Next to the organization, click Settings.

-

If you are an organization owner, in the "Access" section of the sidebar, click Billing and plans.

-

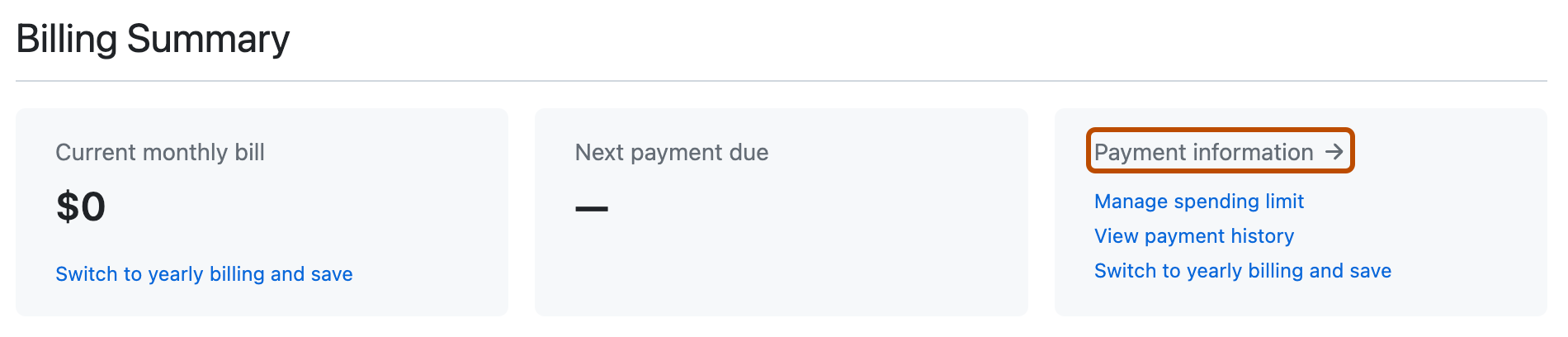

At the top of the page, click Payment information.

-

Review your "Billing information" and update any incorrect data. You must ensure that the address fields are correct and that the "City" and "Postal/Zip code" fields are accepted. If there is any missing information or any errors are reported, the option to upload a sales tax certificate is hidden.

-

At the bottom of the page, next to "Sales Tax" in the "Additional information" section, click Upload certificate, and select the certificate file you want to upload.

-

To remove a sales tax certificate, click next to the certificate you want to remove.